Require immediate cash? Discover swift online loans ⚡ with CashX in Sri Lanka – a reliable online loan provider delivering ✅ instant approval accessible 24/7 ⏰

In a world where financial needs can arise unexpectedly, having access to quick and reliable loan services becomes paramount. CashX, a reputable online loan service in Sri Lanka, offers a solution tailored to meet the urgent financial requirements of individuals. This eview aims to provide a thorough analysis of CashX’s fast online loans, exploring their features, advantages, application process, and addressing common queries to empower potential borrowers with the necessary information.

Fast Loans Online with CashX

CashX distinguishes itself by providing fast loans online with instant approval, a crucial feature for those in urgent need of financial assistance. The key parameters include:

- Loan Amount: Ranging from Rs. 5,000 to Rs. 50,000

- Loan Term: Flexible repayment period spanning from 5 days to 30 days

- First Loan Fees: Enjoy a 0% fee on your initial loan

- Loan Decision Time: Experience swift decisions within 5–15 minutes

- Occupation Requirement: Applicants should be currently employed or possess a stable income

- Documentation: Simplified requirements with the need for a National Identity Card (NIC) and a mobile phone

Speed and Accessibility

One of CashX’s notable attributes is its remarkable processing speed and round-the-clock accessibility. Understanding the efficiency:

- Initial application responses within 15–30 minutes, subsequent applications processed within 5–15 minutes

- Funds credited to your card within 1 hour for the first call, and 20–40 minutes for subsequent calls

- Operating 24/7, eliminating the constraints of traditional working hours

Quick Online Loans vs. Bank Loans

A comparative analysis of obtaining quick online loans from CashX against traditional bank loans reveals distinct advantages:

- CashX offers significantly faster processing times compared to banks

- While some banks may demand income certificates, CashX provides a quicker alternative without such prerequisites

- CashX stands out as a more convenient and expeditious option for those seeking immediate financial solutions

Conditions for Getting an Urgent Cash Loan in CashX

Understanding the terms and conditions for securing an urgent cash loan from CashX:

- Loan amounts extend up to Rs. 50,000, with a flexible repayment period of up to 30 days

- An added advantage is the option to extend the loan term without adversely affecting credit history or incurring additional penalties

Advantages of CashX

Exploring the multifaceted advantages that CashX offers to borrowers in need of fast online loans:

- Fast approval times, with responses as low as 5–15 minutes for returning customers

- The unique proposition of funds being transferred within 1 hour for the first loan

- Entirely online application process, offering convenience and accessibility without the need for physical visits

- Unsecured loans, eliminating the requirement for collateral or a guarantor

- Flexible loan terms extending up to 30 days, with the option to extend without negative credit implications

- Operational 24/7, ensuring anytime access without the limitations of traditional working hours

- Minimal eligibility requirements, catering to a broad spectrum of borrowers, including those with a steady income and valid identification documents

- Robust security measures to safeguard personal and financial information through secure online transactions, adhering to privacy regulations

How to Take a Loan from CashX

A detailed step-by-step guide on navigating the loan application process with CashX:

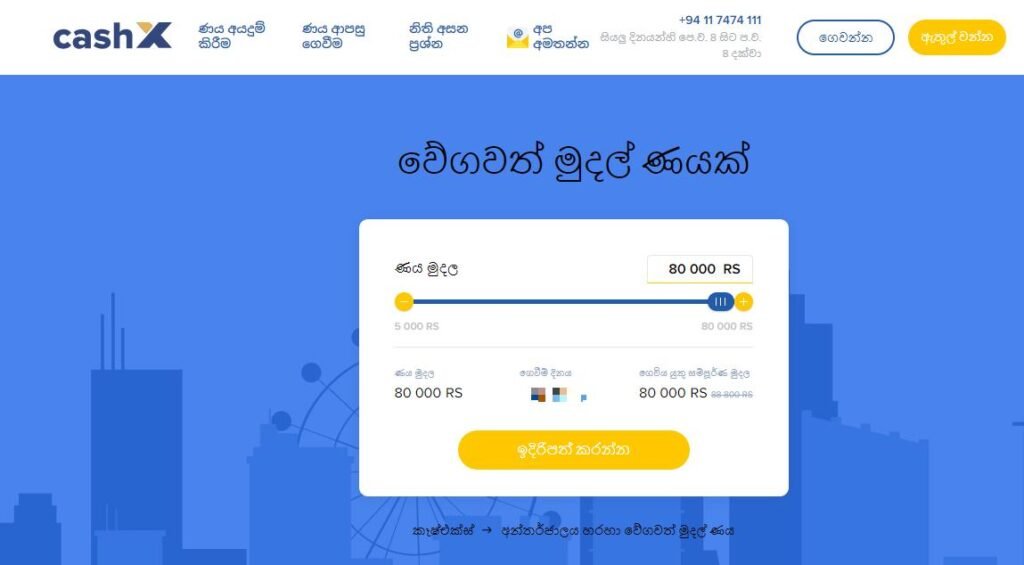

- Visit the CashX website and locate the user-friendly online application form.

- Utilize the loan calculator to determine the desired loan amount and term.

- Fill out the online form with accurate personal information, including contact details and employment status.

- Provide the necessary documents, such as a photo of your National Identity Card (NIC), Passport, or Driving License for identity verification.

- Thoroughly review and submit the application form, awaiting prompt approval.

- Response times are notably swift, ranging from 15–30 minutes for first-time applicants and 5–15 minutes for returning customers.

- Upon approval, CashX efficiently transfers the funds directly to the applicant’s bank account.

- Ensuring timely loan repayment within the agreed-upon period is crucial. In cases of difficulty, applicants can request an extension without negatively impacting their credit rating or incurring extra penalties.

What You Need to Obtain a Loan

A comprehensive overview of the prerequisites for obtaining a quick cash loan from CashX:

- Age between 20 and 60 years

- Employment status or a reliable, steady income

- Accurate personal information, including a registered phone number

- Inclusion of a landline number at the workplace

- Submission of a photo of the National Identity Card (NIC), Passport, or Driving License for identity verification

FAQ

Addressing common questions potential borrowers might have about fast loans and CashX:

How to get a fast loan onlin

A detailed guide is provided, emphasizing accurate information and required document submission.

Where to get a fast loan online

CashX is highlighted as a reliable lender in Sri Lanka, known for low fees and service charges.

Legitimacy of fast loan advances

While instant loan advances from CashX are considered legitimate, a cautionary note encourages potential borrowers to research and verify the legitimacy of any online lender to avoid scams and fraudulent practices.

Where to get a fast loan today

CashX emerges as the preferred choice, offering same-day loans with a straightforward application process. By visiting their website and completing the application, approved applicants can receive funds within minutes to hours.

Conclusion

CashX emerges as a financial ally, providing not just a loan service but a comprehensive solution for those in need of swift and accessible financial assistance in Sri Lanka. With a commitment to efficiency, security, and customer convenience, CashX stands out as a top choice, setting a standard for the seamless integration of technology and finance to empower individuals on their financial journey. In a landscape where time is of the essence, CashX proves to be a reliable partner, offering a beacon of financial relief to those navigating unexpected financial challenges.

ශ්රී ලංකාවේ අඩු පොලී අනුපාතයක් සහිත හොඳම ඔන්ලයින් ණය

Loan type

Short termFor a period of

30 daysRate ()

1.00% / dayLoan amount

40000 €Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

122 daysRate (ARP)

12.00% / yearLoan amount

40000 $Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

28 daysRate ()

0.04% / dayLoan amount

60000 $Approval in

0 minutesFirst loan free

yes