Ceyloan Loan Sri Lanka is a modern lender offering rapid, instant cash deposits directly into your bank account within just 10-15 minutes. Our entire process is conducted online, ensuring a seamless and convenient experience. Although we are a relatively new company with no existing reviews, we invite you to give our service a try.

However, we strongly recommend that you carefully review all the terms and conditions before applying for a loan. Experience swift and hassle-free financial assistance with Ceyloan Loan Sri Lanka today.

Ceyloan Loan Features

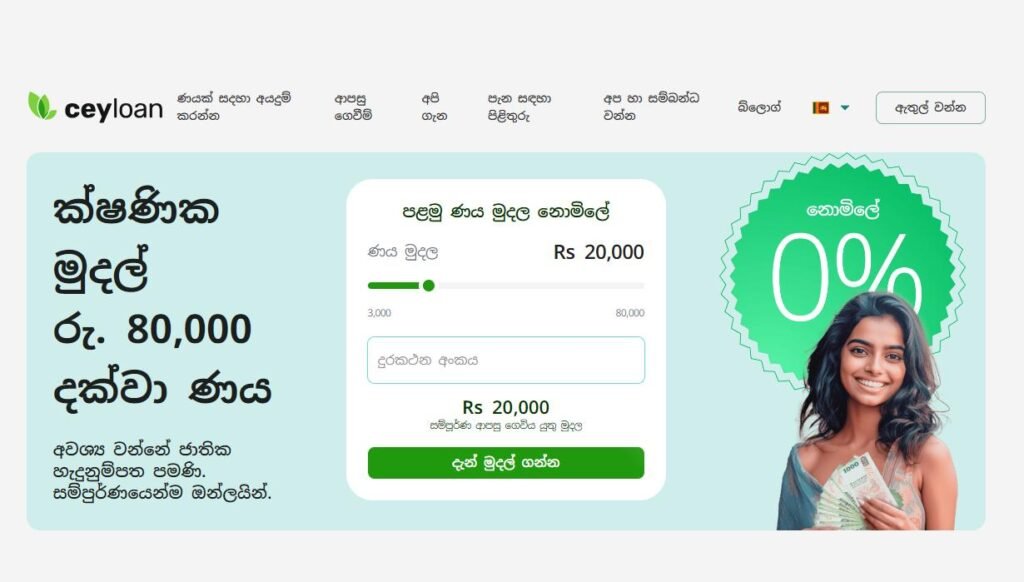

Ceyloan Loan positions itself as an online lender in Sri Lanka, specializing in providing installment loans. Let’s take a closer look at the key features that define Ceyloan Loan’s offerings:

- Loan Amount: The most striking feature is the substantial loan amount on offer, allowing borrowers to access loans of up to Rs. 80,000. This flexibility enables borrowers to address various financial needs, from urgent medical expenses to education-related costs.

- Loan Period: Ceyloan Loan offers a range of loan repayment terms, extending from 91 days to 180 days. This flexibility in loan duration allows borrowers to choose a repayment plan that aligns with their financial capabilities.

- Interest Rate (APR): It is worth noting that Ceyloan Loan operates with an annual percentage rate (APR) of 182.5%. While this rate may seem high, it is important to consider the convenience and accessibility that Ceyloan Loan provides, especially for those who may not have access to traditional banking services.

- Eligibility: Ceyloan Loan extends its services exclusively to Sri Lankan residents aged 21 to 60 years who are currently employed and possess a valid national identification card (NIC). The simplicity of these eligibility requirements ensures that a wide range of individuals can access their financial assistance.

Positives:

- Online Application: Ceyloan Loan’s online application process is a significant advantage. This means that potential borrowers can complete the entire application from the comfort of their homes, eliminating the need for time-consuming visits to brick-and-mortar financial institutions.

- Mobile App: For Android users, Ceyloan Loan offers a mobile application, enhancing accessibility and convenience further. Mobile apps have become an essential tool for modern consumers, and Ceyloan Loan recognizes this by providing an efficient mobile platform.

- Promotions: The institution periodically rolls out various promotions, providing borrowers with the opportunity to access loans with potentially lower fees and attractive terms.

- 24/7 Service: Ceyloan Loan’s round-the-clock customer service ensures that assistance is available whenever it is needed, regardless of the time of day.

- Seamless Experience: The application process and loan repayment experience are reported to be seamless and hassle-free, which is a significant benefit for borrowers seeking quick solutions to their financial challenges.

Negatives:

- High Interest Rate: One notable drawback is the relatively high interest rate of 182.5%. Borrowers must carefully consider the cost of borrowing through Ceyloan Loan and evaluate whether this expense aligns with their financial situation and needs.

- No iOS App: Unfortunately, Ceyloan Loan has not yet developed a mobile application for iOS users, limiting accessibility for a portion of potential borrowers who use Apple devices.

Applying for a Ceyloan Loan in Sri Lanka

The application process for a Ceyloan Loan is designed to be straightforward and efficient, catering to individuals in need of swift financial assistance. Below are the detailed steps to apply for a Ceyloan Loan:

- Visit the Official Website: Begin by visiting the official Ceyloan Loan website at https://ceyloan.lk. This can be done from a computer or mobile device, providing flexibility in the application process.

- Registration: The initial step involves registering for an account on the platform. This account will serve as the central hub for your loan application and repayment process.

- Loan Customization: After registration, borrowers can select their desired loan amount and loan period. This customization allows borrowers to tailor their loans to their specific needs, ensuring that they are not overburdened with repayment obligations.

- NIC Verification: As part of the application process, borrowers are required to provide their national identification card (NIC) for verification purposes. This ensures that only eligible individuals can access Ceyloan Loan’s services.

- Review and Accept Terms: Before finalizing the application, it is crucial to carefully review the terms and conditions of the loan. Borrowers should ensure that they understand the repayment schedule, including interest rates and any applicable fees.

- Application Submission: Once satisfied with the terms, borrowers can submit their loan application through the online platform. The efficiency of this process is a significant advantage, especially in emergency situations.

- Funds Disbursement: Upon approval, the borrowed funds are promptly disbursed to the borrower’s bank account. This quick turnaround time is crucial for individuals facing urgent financial needs.

- Timely Repayment: Borrowers are reminded of the importance of adhering to the agreed-upon repayment schedule. Timely repayment not only ensures the borrower’s financial stability but also contributes positively to their credit history.

Eligibility Requirements:

To qualify for a Ceyloan Loan, applicants must meet the following criteria:

- Sri Lankan Citizenship and Residence: Ceyloan Loan is exclusively available to Sri Lankan citizens and residents.

- Age: Applicants must fall within the age range of 21 to 60 years at the time of application.

- Current Employment: Proof of current employment is a requirement, demonstrating the borrower’s ability to repay the loan.

- Bank Account: Borrowers must possess an active bank account to facilitate the disbursement and repayment of funds.

- Identification: For the loan application, borrowers are required to provide either a valid national ID card (NIC) or a driver’s license.

- Mobile Phone: An active mobile phone number is essential for communication and verification purposes throughout the loan application and repayment process.

Ceyloan Mobile Application

Ceyloan Loan recognizes the importance of mobile technology in today’s fast-paced world. To cater to the needs of its tech-savvy clientele, the company offers a mobile application designed specifically for Android users.

The Ceyloan Loan mobile app streamlines the loan application process further, allowing users to access their services with ease and convenience. For new customers, there is a compelling incentive to try out the app – a nearly interest-free initial loan, featuring a minimal 0.01% interest rate and a 0% service fee. The efficiency of the app ensures that approved funds are disbursed directly into the borrower’s bank account within a remarkable 60 minutes after the application is submitted.

Repayment Options

Repaying a loan is a critical aspect of the borrowing process, and Ceyloan Loan offers borrowers a variety of methods to ensure a hassle-free repayment experience. These options cater to different preferences and circumstances, further enhancing the accessibility of their services. The available repayment methods include:

- Online Payments via E-Wallets: Borrowers can choose to make payments online through popular e-wallets such as DirectPay and Pay&Go. This option is particularly convenient for those who prefer digital transactions.

- Cash Deposit Machines: For those who prefer cash payments, Ceyloan Loan provides the option to make payments at cash deposit machines, including those operated by Pay&Go and Sampath Bank.

- Bank Online: Borrowers can opt for online banking services offered by Sampath Bank, Cargills Bank, or utilize their bank cards for hassle-free repayments.

- Cash Payments via the Counter: In-person cash payments are accepted at various locations, including Cargills Food City, Cargills Bank, and Sampath Bank counters. This caters to borrowers who prefer the traditional approach to making payments.

These multiple repayment methods underscore Ceyloan Loan’s commitment to making the loan repayment process as accessible and accommodating as possible.

Contacting Ceyloan LK

Effective communication is crucial when dealing with financial institutions, and Ceyloan Loan provides multiple channels for borrowers to get in touch with their support team. Whether it’s for inquiries, feedback, or general assistance, Ceyloan LK’s dedicated support team is readily available to provide the necessary guidance and information. The contact details for Ceyloan LK are as follows:

- Company Name: CeylonTech Lanka Private Limited

- Website: https://ceyloan.lk/

- Email: support@ceyloan.lk

- Phone: 0114279800

- Mobile App: https://play.google.com/store/apps/details?id=lk.ceyloan.app&hl=en_US

- Address: CeylonTech Lanka Private Limited No 25, Simon Hewavitharana Road, Colombo 3, Sri Lanka

Frequently Asked Questions

In any financial service, potential borrowers often have a range of questions and concerns. Ceyloan Loan acknowledges this by providing a comprehensive FAQ section on its website. Let’s delve into some of the frequently asked questions and their answers:

Is Ceyloan LK a Legal Company?

One common question asked by prospective borrowers is about the legality of Ceyloan LK. As of the information available, the website does not explicitly state the legal status of the company. It is recommended that borrowers seek additional information or clarification from the company itself or relevant authorities if they have concerns about its legal status.

Can You Share a Loan Example?

Transparency is crucial in financial services, and Ceyloan Loan recognizes this by providing a loan example. Consider the following loan calculation: If a borrower is approved for RS 50,000 at an 18%* APR, their monthly cost would be just RS 442, with a total repayment of RS 8,776 over 6 months. Borrowers are encouraged to review the terms and conditions for detailed loan information.

Is the 1st Loan “Interest-Free”?

Ceyloan Loan seeks to attract new customers by offering an interesting incentive. The initial loan is interest-free, requiring repayment of only the borrowed principal if the deadline is met. Subsequent loans may have interest charges, and borrowers should be aware of these terms when considering additional loans.

Loan Approval and Subsequent Loans

Once a loan application is approved, Ceyloan LK ensures that borrowers are promptly informed of their application’s acceptance through SMS notifications. Borrowers are encouraged to keep their phones accessible and check messages regularly to stay informed about their loan status.

For borrowers seeking subsequent loans, Ceyloan LK provides guidance on the application process:

- Timely Repayment: To enhance eligibility for subsequent loans, borrowers should prioritize the timely repayment of their previous loans. A positive repayment history can significantly impact eligibility and terms.

- Access Personal Account: Borrowers can access their personal account through the Ceyloan website or app, streamlining the application process for subsequent loans.

- “Get Money” Button: Within their account, borrowers can locate and click the “Get Money” button, which initiates the loan application process.

- Provide Required Details: Borrowers should follow the instructions to complete the loan application, providing the necessary details and documents.

- Tailored Offers: If immediate loan offers are not available, Ceyloan Loan assures borrowers that a tailored offer is being prepared. It’s essential to remain patient and continue fulfilling prior loan payments.

- Stay Informed: Borrowers are advised to stay updated with Ceyloan’s notifications, SMS alerts, and app notifications to ensure they receive optimal loan terms and conditions.

Reasons for Loan Application Rejection

Loan application rejection can be a challenging experience, and borrowers often seek clarity on why their application was not approved. Ceyloan Loan provides insights into potential reasons for loan application rejection, including:

- Accuracy of ID Details: Ensuring the accuracy of provided national ID details is essential. Errors or discrepancies in this information can lead to application rejection.

- Credit History: Late payments or defaults with other financial services can negatively impact a borrower’s creditworthiness, potentially leading to rejection.

- Borrowing Limits: Borrowers exceeding borrowing limits with existing loans may face rejection. Managing existing debts responsibly is crucial.

Ceyloan Loan emphasizes that borrowers can take steps to improve their approval chances:

- Update and Verify ID Details: Keeping national ID details updated and verified can enhance the likelihood of loan approval.

- Timely Payments: Prioritizing prompt payments and settling existing debts can positively influence creditworthiness.

- Manage Existing Debts: Managing existing debts responsibly ensures that borrowers maintain a manageable borrowing limit. Different lenders have varied approval criteria, so if an application is rejected, exploring alternative financial options is recommended.

Conclusion

Ceyloan Loan has emerged as a financial service provider in Sri Lanka, offering accessible and convenient access to funds for residents facing various financial challenges. As a relatively new player in the market, Ceyloan Loan is striving to carve its niche and gain the trust of the Sri Lankan populace.

The financial landscape in Sri Lanka is diverse, with established institutions and lenders. For Ceyloan Loan to succeed, it must earn the trust and confidence of its potential borrowers. This trust is often built over time through consistent service delivery and a track record of reliable support.

As we conclude this review, it’s essential to acknowledge that the financial sector is dynamic and ever-evolving. Ceyloan Loan’s impact on the market will depend on various factors, including customer satisfaction, the company’s ability to adapt to changing needs, and its commitment to transparency and responsible lending practices.

For potential borrowers considering Ceyloan Loan’s services, it is advisable to explore the company’s website thoroughly and carefully review the terms and conditions of any loan agreement. Assessing how well Ceyloan Loan aligns with one’s financial needs and goals is a critical step in making an informed borrowing decision.

In conclusion, Ceyloan Loan holds promise as a source of financial assistance in Sri Lanka, and its future trajectory will be determined by how well it meets the needs and expectations of its customers. Continued vigilance, informed decision-making, and responsible financial management are key elements to navigate the world of lending, regardless of the lender or platform chosen.

ශ්රී ලංකාවේ අඩු පොලී අනුපාතයක් සහිත හොඳම ඔන්ලයින් ණය

Loan type

Short termFor a period of

30 daysRate ()

1.00% / dayLoan amount

40000 €Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

122 daysRate (ARP)

12.00% / yearLoan amount

40000 $Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

28 daysRate ()

0.04% / dayLoan amount

60000 $Approval in

0 minutesFirst loan free

yes